The retirees are alright: More than 60% say they're doing OK, but financial concerns remain

Planning for retirement can go a long way in building a healthy nest egg — not to mention calming worries about struggling financially during our golden years. So how well have retired Americans fared with planning for their financial health?

The good news is that data from the Federal Reserve and Social Security Administration shows that most retired Americans said they were "at least doing okay" with finances, though some still worried about the cost of living. The report found that unmarried retirees and those with disabilities were the most likely to report concerns about their financial well-being, and these groups reported lower levels of financial health. Additionally, 9% of people over 65 live in poverty.

To get a better snapshot of American retirees, it’s important to understand the population we’re talking about. A little more than 1 in 4 adults in the U.S. considered themselves retired in 2021, according to the Federal Reserve. According to the Social Security Administration, as of 2022, 47.9 million retired workers receive Social Security benefits. The reasons Americans left the workforce varied: Some simply said they had reached the right retirement age, while others reported that they were ready to do other things and spend more time with family. Some stopped working, but not necessarily by choice: major life events, such as health problems and having to care for family members, and a lack of work opportunities led to 45% of adults retiring.

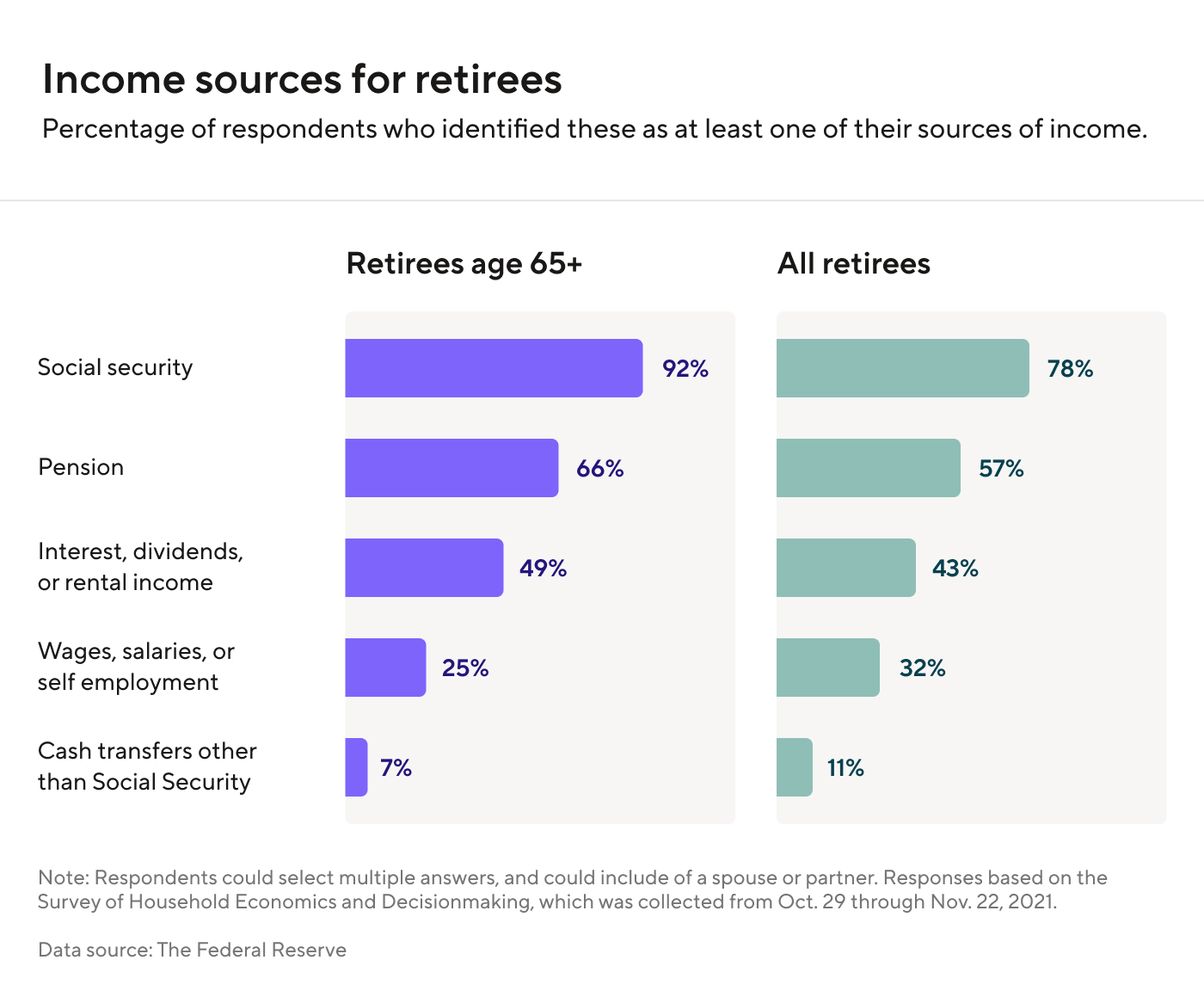

Retirees report having different sources of financial support and income, including collecting rent from owned property and withdrawing 401(k) and pension plans. As of 2022, 47.9 million retired workers aged 65 and older received Social Security benefits. Among the elderly, more than a third reported that Social Security made up at least half of their income. About 14% of adults who considered themselves retired said that they still occasionally worked for pay.

For a more in-depth look at how retirees are feeling about their finances, continue reading to find out more about their economic well-being.

Overall financial well-being

About 88% of married retirees and 68% of unmarried retirees said they are "at least doing okay" regarding finances in 2021.

Retirees as a group reported to the Federal Reserve that their level of financial well-being was generally high in 2021. However, those who were unmarried reported lower levels for this subjective measure, with the group coming in at 20 percentage points lower than all retirees. Additionally, rates were lower for retirees with disabilities compared to those without. Though a retiree with a disability may be eligible for Supplemental Security Income assistance, making ends meet can be challenging given that prescriptions and health insurance can be costly.

Poverty

The U.S. Census Bureau data shows that 9% of people over 65 live in poverty, which has remained relatively consistent since at least 1995.

Though fewer people aged 65 and over live in poverty compared to the rest of the population, it’s not by much: 10.4% of American adults and 16.1% of children live below the poverty line. The poverty rates among people aged 65 depend largely on where they live—19 states and Washington D.C. had notably higher than average poverty rates.

Additionally, women experience higher poverty rates, and have often faced obstacles to retirement security, including leaving the workplace earlier than they'd planned. Some also noted that they lacked access to financial education or saw a drastic change in their financial situation due to divorce.

Reasons for retiring

Nearly half of retirees chose to retire because they wanted to do other things or "reached the normal retirement age." About 3 in 10 said they retired due to a health problem.

Life events also played a factor in why retirees chose to stop working, with health problems as the leading reason that affected a person's ability to continue working. The Fed found that 15% of retirees reported leaving the workforce to care for family members, while 10% said they found fewer work opportunities, or were forced to retire by their employers. Additionally, many retirees considered the COVID-19 pandemic a strong motivating factor in their decision to retire.

Overall financial well-being

Many younger baby boomers — those aged 55 to 64 — were able to benefit from the historic rises in both the housing and stock markets during the pandemic, enabling them to retire early with a financial boost. However, the pandemic also exacerbated wealth disparities for many, with some older workers losing their jobs due to shutdowns or finding themselves financially unable to retire early. Additionally, those who couldn't find a new job during the pandemic may have had to shift into retirement before they were financially or emotionally ready.

Income

In 2021, more than 3 in 4 retired workers reported receiving Social Security as an income source. This rate has remained relatively constant since at least 2013, according to the Fed. More than 46 million retired workers were receiving a $1,555 monthly Social Security benefit on average, according to a June 2021 snapshot. Effective January 2023, monthly benefits will increase due to a cost-of-living adjustment of 8.7%.

Among those who receive Social Security benefits, the payments accounted for at least half of retirement income for 42% of elderly women and 37% of men. More than half of all retirees receive a pension, whereas 43% report receiving payments from financial investments and rental property. As for older Americans who are still working, many are doing so into their 70s. What fuels this trend is rising education attainment levels, as well as financial need. Professions that are friendly to those working in their 70s and older include white-collar jobs within fields such as business, education, law, medicine, and the arts.

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax advice that considers all relevant facts and circumstances. You are advised to consult a qualified tax professional before relying on the information provided herein.